Expert ITR Filing Made Easy

Filing your Income Tax Returns (ITR) has never been simpler! At MAXRISEWEALTH, we offer expert tax filing services tailored to your needs. Our team of experienced professionals ensures that your tax filing process is hassle-free, accurate, and compliant with the latest tax regulations.

Why Choose Us?

Certified Experts: Our team consists of experienced tax consultants and chartered accountants who are dedicated to providing you with the best service

Accuracy & Compliance: We make sure your returns are error-free and fully compliant with all government guidelines and tax laws.

Tailored Solutions: Whether you're a salaried individual, a freelancer, or a business owner, we provide customized solutions that suit your specific tax needs.

Confidential & Secure: Your data privacy and security are our top priority. We use advanced encryption and security measures to safeguard your sensitive financial information.

Fast & Hassle-Free: Say goodbye to tedious paperwork and confusing forms. We handle everything for you, ensuring your returns are filed quickly and efficiently.

Transparent Pricing: No hidden costs or surprise fees. Our pricing is straightforward, and you'll know what you're paying for upfront.

Our Services Include:

Individual Income Tax Return Filing:For salaried individuals, pensioners, and those earning income from other sources.

Business Income Tax Filing: Specialized services for business owners, freelancers, and professionals.

Capital Gains Tax Return Filing: Filing for individuals and businesses with income from investments and property sales.

NRI Tax Return Filing: Tailored tax services for Non-Resident Indians to comply with Indian tax laws.

TDS Compliance & Return Filing: Assistance with TDS deduction, compliance, and return filing for businesses.

How It Works?

Share Your Documents: Upload or send us your financial documents, such as Form 16, bank statements, investment proofs, and more.

Review by Experts: Our tax professionals will review your details and calculate your tax liability.

File Your Returns: Once you approve, we will e-file your returns with the Income Tax Department.

Post-Filing Support: We assist you with any queries or notices from the Income Tax Department after your return is filed.

Get Started Today!

Don't let tax filing stress you out. Let us handle the paperwork while you focus on what matters most. Contact us today for a consultation, and we'll ensure your taxes are filed on time, accurately, and with maximum tax savings.

The Income Tax Regime in India offers taxpayers two options: the Old Regime and the New Regime. Both regimes have different tax slabs and varying benefits. Below are the income tax slabs for the financial year 2023-24 (Assessment Year 2024-25):

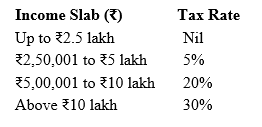

Income Tax Slabs 2024 for Old Regime (with deductions)

Under the old regime, taxpayers can claim various exemptions and deductions, such as HRA, LTA, and deductions under Section 80C, 80D, etc.

Rebate under Section 87A: Taxpayers with income up to 5 lakh are eligible for a rebate, meaning their tax liability can become zero.

Deductions: Various deductions like 1.5 lakh under Section 80C, medical insurance under Section 80D, home loan interest, and more.

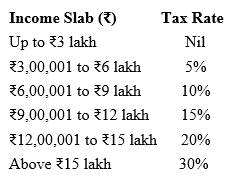

Income Tax Slabs 2024 for New Regime (without deductions)

The new regime does not allow most deductions and exemptions but offers lower tax rates and simpler filing. The slabs are as follows:

Rebate under Section 87A: Available for individuals with income up to 7 lakh, making their tax liability effectively zero.

Standard Deduction: As of Budget 2023, the new regime allows a standard deduction of 50,000 for salaried individuals.

Key Differences Between Old and New Regime

1.Deductions & Exemptions:

Old Regime: Allows claiming of deductions like Section 80C, HRA, LTA, etc.

New Regime: Most deductions and exemptions are not available, except for a standard deduction for salaried individuals. .

2.Tax Rates

Old Regime: Higher tax rates but with the benefit of claiming deductions.

New Regime: Lower tax rates but with limited or no deductions.

3.Who Should Opt for Which?

Old Regime: Beneficial for those who have significant deductions and exemptions to claim.

New Regime: Ideal for taxpayers with fewer investments and deductions.

Taxpayers can choose between the two regimes while filing their income tax returns based on what works best for their financial situation.

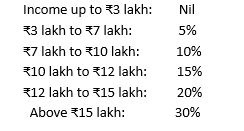

In the Union Budget of July 2024, several key changes were introduced to the New Tax Regime for individual taxpayers in India:

1.Revised Tax Slabs:

These changes are aimed at providing relief to taxpayers, especially those in the middle-income brackets. For instance, those earning between 6-7 lakh will now pay 5% tax instead of the previous 10%, and individuals earning between 9-10 lakh will pay 10%, down from 15%

Standard Deduction Increase:

The standard deduction for salaried employees has been raised from 50,000 to 75,000, which provides additional relief, especially for middle-income earners.

3. Deductions and Contributions:

Amendments have been made to Section 80CCD to increase the allowable deduction on employer contributions to pension schemes from 10% to 14% of the salary, bringing non-government employees in line with government employees.

These updates are designed to stimulate spending by increasing disposable income, particularly for those earning up to 10 lakh annually

Get In Touch

We invite you to explore how MAXRISEWEALTH can help you achieve your financial aspirations. Contact us today to schedule a consultation and take the first step towards a more secure and prosperous future.